Baron Accounting Can Be Fun For Everyone

Table of ContentsGetting My Baron Accounting To WorkNot known Facts About Baron AccountingBaron Accounting Fundamentals Explained3 Easy Facts About Baron Accounting ShownThe Ultimate Guide To Baron Accounting

Intend to simplify your life and maintain more cash in your pocket? Explore Sleek's reliable accountancy, bookkeeping, and tax obligation compliance solutions today. One of the biggest advantages of working with a tax accountant is their experience and understanding. Tax obligation legislations are continuously transforming, and it can be challenging to stay up to date with all the current advancements.

From savvy financial investment relocations to retired life planning, they'll assist you via the financial labyrinth to keep even more cash in your pocket at tax obligation time. Tax accountants are a business's ideal buddy when it comes to navigating the complex globe of taxes (Lodge Tax Return Online Australia). They'll prepare and submit your organization tax obligation returns, offer guidance on how your decisions will certainly influence your taxes, and even assist with pay-roll taxes and worker advantages

Some Known Questions About Baron Accounting.

One of the very first things to search for when selecting a tax accounting professional is their credentials and qualifications. Ideally, you want to collaborate with a licensed Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Enrolled Representative (EA). These classifications show that the accountant has actually fulfilled strenuous educational and experience needs and is certified to stand for clients prior to the IRS.

As a business proprietor, tax obligation accountancy is a vital aspect of your monetary administration - Registered ATO Tax Agent Service. From picking the appropriate organization entity to remaining compliant with tax laws and regulations, there are numerous factors to consider when it comes to managing your company taxes. Below's what you require to understand regarding tax accounting for organizations

Top Guidelines Of Baron Accounting

(https://www.giantbomb.com/profile/baronaccqld/)Staying compliant with tax legislations and policies is vital for businesses of all dimensions. This involves declaring all essential tax obligation types and records, such as revenue tax obligation returns, pay-roll tax obligation reports, and sales tax obligation returns. Failure to follow tax legislations can cause charges, rate of interest fees, and also lawful consequences.

Thankfully, a competent tax obligation accounting professional resembles a superhero for your finances they've obtained the knowledge and proficiency to assist you with the puzzle of regulations, clarify how the updates will affect you, and create smart approaches to minimize what you owe. Tax obligation legislations are always altering, however that does not mean you have to anxiety.

The future of tax obligation bookkeeping is below, and it's powered by innovation. Among the most significant means modern technology is influencing tax obligation accounting is with the growth of advanced software application and devices. These tools automate a lot of the time-consuming jobs entailed in tax obligation preparation and filing, such as data entrance, computations, and type generation.

Some Known Factual Statements About Baron Accounting

, a tax obligation consultant ensures their customers stay compliant with state and government tax regulations, also if they have complex economic situations. Assume of a tax advisor as your overview on a complicated tax trip.

Generally, tax experts have much more experience and education and learning than accountants and are fluent not just in accountancy, but in tax obligation law, money, and company method. Along with being a qualified public accountant (CERTIFIED PUBLIC ACCOUNTANT), they might likewise have actually a registered representative classification or a financial consultant certification. They may also be a tax attorney.

This shift puts your unique knowledge and experience at the facility of your value suggestion. The majority of tax obligation and accounting companies build their service design on the variety of income tax return completed. However, they are usually responding to tax-related inquiries and offering advice for customers throughout the yearwithout being made up for it.

Customers are willing to pay a premium when they comprehend the value being provided. That is how today's accountants can construct effective and sustainable services that flourish lasting (Simple & Easy Tax Return AU).

Not known Factual Statements About Baron Accounting

Audit experts have a major duty in the decision-making process for lots of businesses as they make certain that companies adhere to tax laws.: A Chartered Tax Obligation Professional (CTP) aids individuals and companies with enhancing various earnings tax obligation circumstances and declaring income tax returns for people, small companies, partnerships, and single proprietorships.

In this article, we'll discover some reasons to pick a tax obligation accountant for a business. Many company owner avoid looking for aid from a tax accounting professional to conserve cash, yet sometimes, due to an absence of expertise and details regarding tax obligations, they lodge income tax return with wrong information and wind up paying more than necessary.

The procedure can be taxing and stressful and anchor may cause disturbance in your company procedures. With a tax accountant by your side, you do not require to face it. During a tax season, a tax obligation accountant can make the procedure a lot easier and reduce the chances of monetary coverage errors.

Molly Ringwald Then & Now!

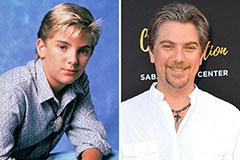

Molly Ringwald Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now!